Who Makes A Million Dollars A Year? The Top 0 1% Income Wealth

If you need to reach a business that allows you to earn your first million, you need to construct credibility, which is a long-term and steady engagement. Infusing credibility into your tradition or firm values may help the business thrive in a extremely competitive market.

What’s more, you’ll be able to turn to your millionaire friend(s) for advice. And because they’re already there, you’ll have the ability to trust you’ll be getting the right advice. Armed with the information that your small business can succeed because of your facet hustle expertise, you’ll have the boldness to take your corporation as far as your skills and efforts can. If your employer will present a 50% matching contribution on as much as a 10% contribution by you, that can add an extra 5% to your plan each year. It’ll increase your complete contributions from 10% to 15% annually.

Far too many individuals are totally obsessed with developing with a million-dollar concept in the hope it will make them millions make1m of dollars. Let’s assume that you simply’re not actively working to earn one million dollars, however that it’s achieved through passive revenue streams.

In 2021, LSU head coach Ed Orgeron is expected to earn $8.7 million and soccer doubtless isn’t going to even be played. In 2023, Lincoln Riley at USC and Nick Sabin from Alabama are expected to earn $10 million a year. The average salary of a Division I football coach is roughly $1.8 million. It is the football coach that is typically the best paid state worker. For example, out of the $700,000 bonus, only $200,000 may be paid in upfront money. You can’t compare a 25-year-old’s income to a 40-year-old’s revenue.

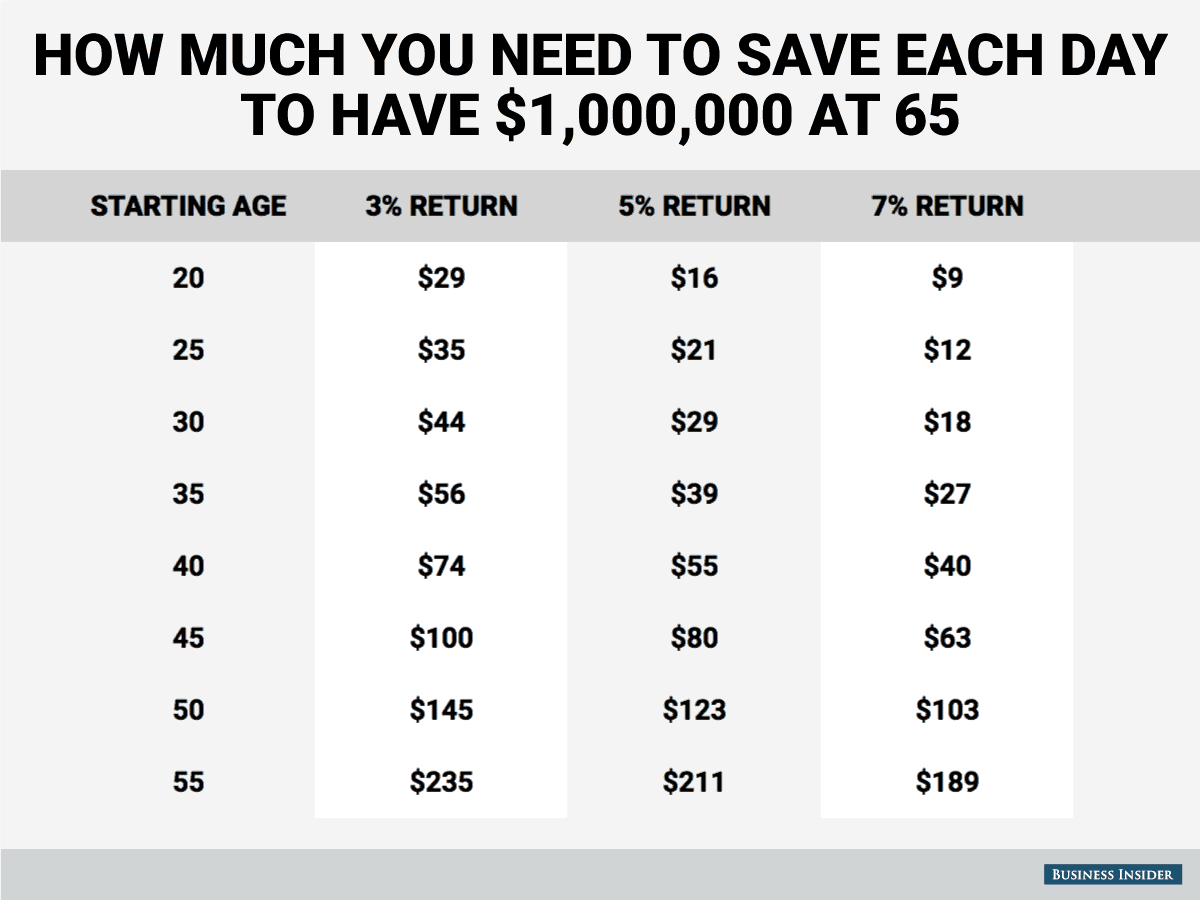

If you determine to place $200 in your 401(k), your paycheck would turn out to be $800 and you’d pay $200 in taxes as a substitute. If most return is what you want, you’ll need a extra aggressive portfolio. If your major goal is capital preservation, you’ll wish to take a safer strategy. But If you’re in your fifties or sixties, you’re in all probability making an attempt to figure out how to invest 1,000,000 dollars and live off the interest if you retire in the next few years.

As a result, it’s important to save heaps of and make investments your money move aggressively. Ideally, you want your cash to work for you so you don’t have to eternally. Instead, it’s greatest to mentally rest to zero so that you don’t relaxation on your laurels. If attainable, determine a method to build a model round your self or your business to guard or broaden your incomes energy. Big tech companies like Google, Facebook, and Apple are able to pay essentially the most. They are probably the most worthwhile and have the biggest market caps. As we’ve discovered from the lockdowns in 2020 and 2021, an internet business is even more useful that earlier than, all things being equal, as a result of its earnings are more defensive.

Make More Money

These policies think about your age and general physical fitness when you set your premiums. Sign up when you’re 50 years old and healthy, and the premiums could be quite affordable. Sign up when you’re in your 60s or 70s, especially when you have a well being situation, and your prices will be a lot larger. According to Anup Kayastha proprietor of AutoLoanCalculator.internet, even a part-time gig, working a single shift per week, may be a nice way to grow your earnings. Take all the money from that job and put it instantly into investments, and you’ll have a sizeable nest egg in no time. Jeff Rose, CFP® is a Certified Financial Planner™, founder of Good Financial Cents, and author of the non-public finance book Soldier of Finance. In addition to his CFP® designation, he additionally earned the marks of AAMS® – Accredited Asset Management Specialist – and CRPC® – Chartered Retirement Planning Counselor.

ULTIMATE MARKETING CHECKLIST

If you’ve a well-diversified portfolio, those low-cost stocks will ultimately acquire worth, growing your investment. If you rent your home, you’re not making one of the best use of your money. Yes, your hire money pays for a roof over your head, but that’s all it does. Your landlord still owns the property, even when you’ve paid hire on time each month for 30 years. Make your mortgage fee on time for 30 years, and you’ll actually own your home. Check out our roundup of the best actual property investment apps. M1 Finance provides a high-yield savings account that presently pays an impressive 5% interest rate for M1 Plus members.

Apart from pondering of a Million dollar product, you want to discover that one person who desires what you have to provide. One example is you presumably can sell a fridge magnet with inspirational quotes. So every time you open the fridge, you presumably can see these quotes and think about being more healthy. Basically, what it involves is understanding what are you going to sell your product for?

If you want to get rich, you might as well give attention to becoming a member of industries that pay very nicely. But there’s extra to simply becoming a member of a well-paying industry to get you to one million dollar revenue. The Federal Reserve units a long-term inflation rate target of 2%, a modest aim fee that aims for financial stability and consumer well-being. The Consumer Price Index is a standard measure of current inflation provided and updated by the us